Renting your French holiday home for long term rentals

- Last updated on .

- Hits: 5217

Find out how you can rent out your second home in France to maximize the rental income and avoid some of the French tax issues and tenancy/legal problems.

Find out how you can rent out your second home in France to maximize the rental income and avoid some of the French tax issues and tenancy/legal problems.

If you own a house in France and you are thinking about renting it out for either summer rentals or for longer term rentals over the winter period, then there are a number of important factors you need to first consider.

- Why are you doing it? - yes a bit of a stupid question, but it does impact how you approach renting out your property

- Marketing - given the increasingly competitive rental market in France (especially the South), how will you make your property stand out from the crowd?

- Property Management - the days of the keyholder in the village leaving a key for guests under a flower pot are long since gone. You need to ensure that your house is properly maintained and guests are received professionally.

- Tax - whether you like it or not, if you own a property in France and you receive rental income on it, then you have to declare that money in France on your tax return. But there are legal ways to reduce the taxation you pay to a minimal amount.

- Legal issues - how to minimize rental disputes and meet your responsibilities as a Landlord

- Rental returns - what sort of income would be a 'good return' on your holiday home?

We have been involved in property rentals in France since 2006 - for both summer holiday rentals and long term rentals. I don't like telling people how to suck eggs, but I do find that some Property Owners can be either incredibly naive when it comes to renting out their holiday homes in France, or the complete reverse - behaving like some Victorian slum-landlord. It doesn't have to be this way. With a bit of common sense and following professional advice, it is certainly possible for a second home in France to more than 'wash its face' every year and to be relatively hassle free. But this doesn't come without a bit of upfront effort and it certainly doesn't come for free

1. Why rent out your holiday home in France

Generally, there are 4 main reasons why property owners decide to rent out their holiday home in France:

Money

As we will see below, if you have a decent property in France and you manage the rentals correctly, you could earn up to €25,000-€40,000 per year. Depending on the location of your holiday home, you can benefit from high earning summer rentals and moderate income from monthly rentals during the off season. As we explain here (Property Investment in South France), properties in the South of France can earn a rental return as high as 9% net yield (which beats current rental returns in London and Paris).

As we will see below, if you have a decent property in France and you manage the rentals correctly, you could earn up to €25,000-€40,000 per year. Depending on the location of your holiday home, you can benefit from high earning summer rentals and moderate income from monthly rentals during the off season. As we explain here (Property Investment in South France), properties in the South of France can earn a rental return as high as 9% net yield (which beats current rental returns in London and Paris).

That is not an insignificant amount of money. When you consider that the average annual salary in France is around €33,000 - which involves working for 1,645 hours per year - then the returns look very healthy for a limited amount of work. But to achieve a steady income and maximise the returns, you need to approach it from a business-like perspective.

If this was your business, would you run it on the basis of asking your neighbour to do you a favour and letting people into the premises every now and then? Would you consider hiding this level of income from the tax man? Would you invest the bare minimum into your business and just try and 'run it on empty' for years and years? Would you ignore professional advice and just try to 'wing' it? Of course you wouldn't, but unfortunately, some property owners look for 'top dollar' returns for a minimal or even zero upfront effort and investment.

If you are renting out property in France, especially if you are based in another country, you need to have professional Property Management in place on the ground. You need (at the very least) to get professional accountancy advice on how to report the income on your French tax return and ideally, you should set up a micro-enterprise (small business) to handle the rentals. You should get proper advice on the rental contracts that you use to avoid any unwanted legal issues. If you want to maximise your returns, you also need to properly benchmark the weekly/monthly rental rates and ensure that you professionally market the property with first class photographs and a detailed description.

Maintenance

Some Owners look to rent out their holiday homes in France in order to generate income to pay for repairs or renovation work, such as installing air conditioning, a new heating system or a swimming pool. This makes perfect sense. The rental income generates the revenue to pay for the upgrade and refurbishment of the property. If you know you have some serious repair works, then you can plan for this to be completed over a 3-5 year time period, self-funded from the property itself. But there are 2 issues that you must consider

Some Owners look to rent out their holiday homes in France in order to generate income to pay for repairs or renovation work, such as installing air conditioning, a new heating system or a swimming pool. This makes perfect sense. The rental income generates the revenue to pay for the upgrade and refurbishment of the property. If you know you have some serious repair works, then you can plan for this to be completed over a 3-5 year time period, self-funded from the property itself. But there are 2 issues that you must consider

Firstly, whilst it may be OK for you to 'slum' it for a couple of weeks with a dilapidated kitchen or without proper heating - you should not expect other people to pay to do so. You have a legal responsibility in France to ensure that the house is comfortable, water-tight and has sufficient heating. You need to ensure that the electrics in the house have been checked by a qualified electrician, the chimney/wood burner is professionally cleaned each year and the electrical appliances meet minimum energy efficiency standards.

Whilst you can furnish the holiday home quite cheaply with beautiful old armoires and lovely oak dining tables from the local brocantes or from Emmaüs - don't fill the house with any old 'tut', just because it is cheap. I remember years ago going to a pretty house in Mirepoix. Well it was pretty on the outside. Inside was another story. In the lounge, there were 4 armchairs (which were more like dining chairs). It looked like a Dentist's waiting room. The beds were all 'antiques' - antiques in the sense that the bed bases were 80 years old and could only accommodate someone under 5 foot 2 inches tall. The mattresses were all second hand, probably the originals. In the kitchen there wasn't a plate, cup, glass, knife or fork that matched. The whole house looked like it had been furnished for about €3.50. Nobody would want to rent this house for longer than a few days, certainly not for a few months. Even a dedicated Spartan would move out.

Furnishing your holiday home on the cheap is fools gold. The second hand furniture will break and need to be replaced. So will the reclaimed fridges and ovens. But most importantly, you will actually reduce the potential rental income. Not every tenant is going to trash your house. Believe it or not, if you furnish your house well, people will look after it and want to stay there. You will also drastically reduce the amount of phone calls and complaints (all of which cost money to rectify). Furnish it like a tip and people will treat it like a tip.

Secondly, if you are going to get work done on your house, for Christ-sakes get the work done by a proper builder who gives you a proper invoice. If you go for the cheapest quote or try and pay for some of the work on the black, it is going to cost you more money in the long-run. In France, the money you spend on refurbishing your house you can be deducted against future Capital Gains Tax. Given that CGT in France is 19% (with a small taper-relief of 6% per year up to 22 years), this could save you a lot of money.

Utilisation

Another reason property owners want to rent out their holiday home in France is because they are finding that they are using it less and less and the house is standing empty over the winter period. Older houses especially, don't do well being shut up for long periods of time, they need to breathe and be lived in. Similarly, if you have someone staying in the house, they can report minor issues to you (like damp spots) before they become major problems. All of this helps to maintain the upkeep and value of the property and will also deter crime.

I know that some Property Owners are happy just to let people stay in the property as house-sitters - usually for free or for a nominal rent. I don't necessarily have a view on this either way and it is certainly a great deal for the house sitter. But what I would add is that if you have anyone staying in your property - even if they are not paying any rent - always make sure that there is a legally-binding rental contract in place. Just because someone is getting a house for free doesn't mean that they will take better care of it. I also think that every house has a value and even if you charge a peppercorn rent, at least this money can be used to pay for re-decoration or replacing appliances - all of which helps maintain the value of the property.

Selling

Finally, it can take a long time to sell a house in France, especially in rural or remote areas. Even a quick sale will take at least 3 months from the initial offer to final completion. It is possible to make it a condition of a rental contract that tenants have to allow sales visits to the property during the lease. My wife works as a Real Estate agent and the data that they have in the agency, is that houses that are currently lived in are twice as likely to sell as vacant properties. It makes sense. If you walk into a cold and damp property, it is hardly the best of welcomes. Having someone in the house whilst it sells, actually helps you to sell it. Also, the rental income you generate can be used to off-set any negotiations on the sale price or Capital gain fees.

2. Marketing your holiday home in France

Every year, over 1,500 new holiday homes in South of France are added to the existing stock of villas and gites advertised on Trip Advisor, Airbnb, Booking.com and VRBO. With the market for rental properties in France becoming increasingly competitive, you really have to get serious about marketing your holiday home for short and long term holiday rentals, to make your property stand out from the crowd.

Every year, over 1,500 new holiday homes in South of France are added to the existing stock of villas and gites advertised on Trip Advisor, Airbnb, Booking.com and VRBO. With the market for rental properties in France becoming increasingly competitive, you really have to get serious about marketing your holiday home for short and long term holiday rentals, to make your property stand out from the crowd.

The market for holiday rentals in South France has changed dramatically in the last 10 years. Now it is the gold standard to provide air con, satellite TV andhigh-speed Wi-Fi in your rental proeprty. If you do not, then another property down the road will and they will take your bookings. Even the traditional French custom of not providing bed linen and instead hiring it out on a weekly basis, is thankfully beginning to change. Also the dreaded "end of stay cleaning charge" is on the way out. All of this has been driven by the competitive market.

The market is also beginning to change in the Long term rental market as well. When we first moved to France in 2006, it was virtually impossible to find any website providing rentals of more than 2 weeks. Part of the reason for this is the French legal regulation surrounding property rentals. But today there are 6 dedicated Long term rental websites in France (including our own Long term rentals in France). Whilst 10 years ago you may have found a queue of eager customers willing to rent your freezing barn of a house half way up a hill, nowadays they have a lot of properties to choose from.

Making your property stand out

With the increase in new rentals coming onto the market, you have to get smart about selling the special features and benefits of your property. What this boils down to is what we call the "money shot". Your property has to have one stand-out photo that combines the main selling feature of your property. The roof terrace, the private pool, the views, the beautiful facade. If you do not have a decent "money shot" then you are certainly going to struggle and I would certainly advise you to spend €150 and get in a professional photographer to take decent photographs. In the grand scheme of things, this is a miniscule amount of money compared to what you could earn renting out your property.

Every property has its own feature: fabulous views, it is close to the beach, it is near a pretty town or village, it is remote and tranquil, it is in a vibrant holiday spot, etc. Whatever it is about your property, you need to articulate this to the buying public. Think of your target audience and why they would want to come and stay in your property. Avoid being bland. Make your property stand out.

Build up your customer reviews

Reviews are King! If you do not have a decent customer feedback score, potential renters will move onto the next property which does. The other thing to remember about customer reviews, is that if done well, they actually help to market your property. Previous guests can wax lyrical about the fabulous restaurants around the corner or the free bottle of wine and case of beer you left in the fridge. If you get some negative feedback, never criticise it. Just state that this has now been fixed and emphasize the positive comments the critical customer made. If you are new on the market and you do not have any customer reviews, then you need to reach out to friends and family who have stayed at your house and ask them to post reviews.

Quick response to customers

Be quick off the mark if you get a booking enquiry. Never lose a potential booking by being slow off the blocks. On our holiday rental website, Go Languedoc, our aim is to respond within 2 hours with confirmation of availability. By responding quickly, we keep the customer looking at our portfolio of rental properties, not at other sites.

3. Professional property management

Renting your house in France out for either summer or long term rentals is a professional business. The income can cover your annual mortgage costs and property taxes. Or if you are lucky to own a holiday home without a mortgage, then your rental income can provide you with a second pension income.

Renting your house in France out for either summer or long term rentals is a professional business. The income can cover your annual mortgage costs and property taxes. Or if you are lucky to own a holiday home without a mortgage, then your rental income can provide you with a second pension income.

So you need to get serious about what you do. Please, please, please, do not engage a little woman in the village as a key holder. She probably doesn't speak English and you will be paying her such a peppercorn income why should she be bothered to resolve any problems. That is not her job. That is your responsibility.

So if you are going to rent out your holiday home in France, then get in proper Property Management. Let them take on the responsibility for ensuring that your guests are comfortable and happy. Make sure you search the market for professional Property Managers. Speak to other owners who rent out their property and ask them who they use.

4. Tax on rental income in France

If you do decide to rent out your holiday home in France for holiday rentals or long term lets, then you also need to be aware of the French taxes involved.

Rental income in France is taxed at a flat rate of 25 per cent for non-residents. Nationals are taxed on a sliding scale with a maximum taxable rate of 25 per cent. If you do rent out your house in France for summer season rentals, then you are also required to declare this with the local Mairie and you maybe liable to pay the taxe de sejour (tourist tax). This is not a large amount (normally €0.70 per person per night.

Normally, if you rent out furnished accommodation on a regular basis, then you are liable to pay the local business rates (Contribution Economique Territoriale (CET) ). In my personal experience this costs around €400 per year, but it will vary depending on your location. However, the good news is that if you rent out your principal residence on a seasonal basis, then you will normally be exempt (provided that you can prove that this is just supplementary income rather than your principal source of revenue). The tax authorities will divide your annual rental income by your total annual revenue to arrive at the decision of whether you are exempt or not. It also should be noted that some commercially-minded local mayors may decide to waive the imposition of the business tax (and the tourist tax) because they are keen to bring in tourists into the town or village.

If you do decide to rent out your property on a semi-regular basis, it may also be worth your while to set up the property as a mini-business in France (Micro-Enterprise). If you do set up a business in this format then you will obtain three years exemption from business rates. There are two different types of Micro-Enterprise that you can set up:

Micro scheme

The Micro scheme is generally simpler to administer and you probably do not need an accountant to help you with your declarations. Under this scheme, the French tax authorities provide a standard 50% tax allowance on the declare rental income. What this basically means is that the French government allow you to keep half of your earnings (without charging tax on it) because they assume that this covers your annual maintenance costs. The other half is then taxed at a rate which depends on your personal financial circumstances. In effect, you will be paying between 15%-25% of your rental income in tax and social charges.

The Micro scheme is generally simpler to administer and you probably do not need an accountant to help you with your declarations. Under this scheme, the French tax authorities provide a standard 50% tax allowance on the declare rental income. What this basically means is that the French government allow you to keep half of your earnings (without charging tax on it) because they assume that this covers your annual maintenance costs. The other half is then taxed at a rate which depends on your personal financial circumstances. In effect, you will be paying between 15%-25% of your rental income in tax and social charges.

So for example, if the annual rental income declared is €20,000, 50% will be deducted for costs, expenses and depreciation; and then taxation and social charges will be applied to the remaining €10,000. You do not need to provide any receipts for the expenses, the deduction is automatically applied by the administration.

Further tax rebates are permitted for special types of furnished accommodation. So the rate of the abatement goes up to 71% for furnished rentals which are registered as tourist accommodation with the local town hall) and also for registered bed and breakfast properties.

Real scheme:

The Real scheme is more complicated to administer, but it can be more tax beneficial. The French tax system under this scheme makes it possible to deduct all the expenses actually incurred in running the rental property. So the types of costs covered will include property maintenance and repairs, agency commission fees, advertising costs, replacement furniture, professional fees associated with the rental, travel costs incurred by the Owner in connection with the rental property, etc. But one of the main benefits of this scheme, is that it also allows for depreciation charges to be applied on the property. So in effect, if the whole house is rented out and the purchase cost of the property was €300,000, then this value can be deducted from the rental income, over a number of years (for example, €20,000 depreciation per year over 15 years). The net effect is that you will pay little or no French income tax on your rental income.

To rent or not to rent, to declare or not declare

Setting up a company in France may sound a bit too complicated or the thought of getting into the French taxation system may not sound very attractive to you at all. When I explain this to a lot of Owners in France, I generally get 2 reactions:

a.) Well, there is no point renting the house out

If you decide not to rent out your house, you will still have taxes to pay in France (taxe fonciere and tax d'habitation), as well as annual maintenance costs. Is it not better to have somebody staying in your house, keeping it warm over the winter, alerting you to any minor issues with the house, and paying you money to cover your fixed costs for the year? If you make a profit on it after tax, then all well and good.

b.) I will rent it out, but I will keep it under the radar (i.e., not declare the earnings in France)

This is a bad idea for two reasons.

1.) the main OTA platforms in France such as Airbnb, VRBO and Booking.com are now watched very carefully by the French tax authorities and the platforms themselves are required to file tax records for the listings. So the risk of getting caught for undeclared rentals has increased in recent years. Added to this, with the abolition of taxe d'habitation for 80% of homes in France, local communes are looking for additional methods for raising revenue locally, with taxe de sejour being the prime example. This is usually a flat charged levied on (tourist) guests staying in hotels and rental properties. The tax is charged per person per night and it is the responsibility of the Owner to declare and pay this tax. So local Mayors in France are less willing to turn a blind eye to unofficial rentals because they now regard them as potential loss of revenue.

2.) You can of course arrange a private rental between yourself and a tenant and you can arrange for this rental to be paid in whatever country you want. It is then up to you to report this income to the relevant tax authorities. That is all well and good, if there are no issues during the rental. But what happens if there is a problem? What happens if the tenant stops paying the rent, or runs up an excessively large electric bill or causes damage to the property? Who are you going to turn to? You won't be able to bring a legal case in Sweden, United Kingdom, Australia or wherever you live - because the rental concerns a house in France. Similarly, if this is an undeclared rental in France, without a proper French rental contract, good luck finding a French lawyer willing to take on that case. And finally, the tenant always has the whip hand of being able to denounce you to the French tax authorities for tax evasion (which is certainly no idle threat).

There is also 2 hidden benefits of setting up a small business in France and paying your taxes and social charges on the rental income. Firstly, under the micro-enterprise system, provided you declare at least €5,500 per year in income, you will be automatically entitled to French health coverage (carte vitale) and this is an enormous benefit. Secondly, provided you declare the required level of income per year, you will also start accruing French pension benefits. The minimum period for qualifying for a French state pension is 10 years of social security contributions. If you hit that figure, then you will qualify for a pension (with a minimum French pension rate of around €634.66 per month). It maybe small beer, but all beer is good!

5. Legal issues on renting out property in France

You may have heard all the scare stories about people who have rented their property in France and have had dreadful problems with the tenants. There is no hiding from the fact that - depending on the type of rental contract - the law is heavily on the side of the tenant in France. I just want to explain the different type of rentals contracts under French law - and the critical distinction between primary and secondary residences - because this matters enormously in terms of the rights of the tenant and the responsibilities of the Landlord.

You may have heard all the scare stories about people who have rented their property in France and have had dreadful problems with the tenants. There is no hiding from the fact that - depending on the type of rental contract - the law is heavily on the side of the tenant in France. I just want to explain the different type of rentals contracts under French law - and the critical distinction between primary and secondary residences - because this matters enormously in terms of the rights of the tenant and the responsibilities of the Landlord.

Unfurnished rentals

The most common property rental contract in France is for unfurnished rentals of 3 years. The rental contract is called Contract Location de logement and it runs to over 30 pages including annexes!!!

An unfurnished rental property in France is normally just a bare property without a fridge, washing machine, oven or even light bulbs.

Typical agreements are automatically renewable for another 3-year period, unless the landlord gives notice 6 months prior the end of the lease period (and if they miss the full notice period, even by one day, then the contract will continue for another 3 years). It is extremely difficult for the Landlord to terminate the rental contract during the 3 year period, even if he/she wants to sell the property. By contrast, the tenant is usually free to serve notice whenever he or she wants to.

By definition, an unfurnished rental will be classified as the tenant's principal residence - and this is a very important classification. It is French law that if a property is a tenant's principal residence:

- the rental contract must be in writing and accompanied by a written document concerning the physical conditions of the accommodation and the inventory of fixtures.

- the tenant has the right to receive a 'quittance de loyer' (rent receipt) for all rent and bills paid.

- the security deposit must be returned to the tenant within 2 months of the end of the lease.

- The landlord is required to provide a range of house reports, including on the state of the electricity supply, if there is any lead materials in the house, risks from flooding and natural disasters, etc.

- if the Landlords wishes to terminate the lease (on the grounds that he/she wishes to sell the property or to use the property themselves), then they must notify the tenant in writing and provide at least 6 months advanced notice.

- In practice, it is virtually impossible to evict the tenant during the winter la treve hivernale (1 November to 31 March), even if they stop paying the rent or cause neighbourhood disturbances.

Furnished rentals (12 months)

Most furnished rental apartments and houses in France will be quite bare. The Law requires just that the property comes with a bed with bedding, shutters or curtains in the bedroom, a stove top or hotplates, an oven or Micro-wave, a refrigerator, a freezer or freezer compartment that freezes to -6°C or less, sufficient tableware, cooking utensils, a table & chairs, shelves, lighting and house cleaning equipment such as a vacuum cleaner, broom or mop.

If the furnished rental property is to be rented as the tenant's principal residence in France, then by law the rental contract is for a minimum period of 12 months. The contract is then renewable on a yearly basis, under the same terms as agreed for the first 12 months (apart from any approved rental increase). Basically, as a Landlord, if you don't want the tenant to stay on in the property after the initial 12 month rental period, you have to formally write to the tenant to explain that the contract will not be renewed. You will normally have to do so at least 3 months before the expiry of the lease. If you miss this time slot, then the contract will flip-over for another year.

Under the French law, (Loi ALUR), Landlords providing furnished rentals need to provide 11 separate house reports (from electrical conformity to flooding risk to lead pipes and energy efficiency), all of which can add up to €3,000 to arrange.

However, if the property is not the principal residence of the tenant (i.e., it is clearly stated that it is rented as a residence secondaire), the tenancy can be for any duration and there is no automatic renewal of the contract at the end of the lease. Furthermore, whilst certain standard of safe living conditions still need to be provided by the Landlord, most of the more onerous restrictions of Loi Alur - and most importantly, a treve hivernale - do not apply.

The French legal definition of a principal residence is as follows:

- it is normally a property where you have been or will be staying for a minimum of 8 months

- the residence must be geographically aligned with your permanent place of work/business, children's schools, social life or other significant aspect of your life

- you do not envisage leaving the property in the near future (i.e., it is your permanent home)

- the residence should also be the official address where you are registered for tax with the French authorities.

The easiest way to look at it is that a principal residence is the tenant's permanent home where they envisage residing for the foreseeable future. The secondary residence is a temporary dwelling, which the tenant envisages leaving at some point in time. Even if the tenant owns no other property in the World or has no other permanent address, it doesn't necessarily mean that where they are currently staying is their residence principal. It is therefore possible for the rental property to be you tenant's main residence but not their principal residence.

I am sorry to labour the point here, but if you have ever dealt with a French tenancy that has gone bad, then this difference between a principal and secondary residence is absolutely critical. It can mean the difference between a 12 month eviction process and an eviction taking a matter of weeks. All the furnished rentals that we arrange through Long Term Rentals in France are specifically for the purpose of a secondary residence.

Holiday rentals

A contrat de location saisonnière d'un meublé is a short term rental contract in France, which can last up to 3 months. Normally these relate to furnished properties. Furnished holiday rentals in France are not subject to TVA (VAT), unless you provide additional services like food or transport. They may however be subject to taxe de sejour (tourist tax).

There is no requirement for there to be a formal written contract (the 'terms' of the contract can instead be implied from a property advert, verbal agreement or house rules/house book).

Responsibilities of a landlord in France

Although some regulations still apply for holiday rentals, seasonal lets and rentals which are specifically determined in the contract as secondary residences; the most significant restrictions are removed. Landlords are however required to have:

- buildings and contents insurance, with some element of public liability insurance (although no minimum level of cover is required).

- if you have a working fireplace or woodburner, you will be required to get it swept professionally every year.

- you will need to make sure that electricity supply, fuse board and electrical appliances comply with current French standards

5. Likely Rental returns

One important issue to remember when it comes to renting out your property is that occupancy is King! Many people get fixated on the weekly or monthly rental price and ignore the fact that this is almost immaterial in the bigger scheme of things. Let me explain this point in more detail.

One important issue to remember when it comes to renting out your property is that occupancy is King! Many people get fixated on the weekly or monthly rental price and ignore the fact that this is almost immaterial in the bigger scheme of things. Let me explain this point in more detail.

So let's say we value your house to rent at €1500 per week in the high season. You may decide that this is an insult. Fred up the road rents his house out at €2500 a week. You're not going to have that! You will press ahead and advertise your house at €2000. You gain an extra +€500 per week.

But the key issue is whether it will rent or not. Every week that your property stands vacant you are losing -€1500. If you look at the figures below, you will see that pricing your property at the right level to ensure you get occupancy is the key issue, not the actual weekly rental price.

- €1500 x 8 weeks rental = €12,000

- €2000 x 4 weeks rental = €8,000

The other thing that you have to consider is that the rental market in France has become extremely competitive. Every year an extra 1500 properties are added to the rental stock in the South of France. In any market, the rule of supply and demand applies. Rising housing stock and stable demand equals at best, static prices. Also, if you are new on the market, you have no experience of renting your house. You have no track record in terms of customer reviews. Fred may well be earning €2500 per week, but he also probably has 10 years worth of customer reviews logged into TripAdvisor, AirBnB or HomeAway.

The other thing that I always tell clients to do is to compare their own property not just with higher earning properties, but also to look at properties in the bracket below. I recently had to value an apartment in the coastal town of Marseillan in the Languedoc. The owner wanted to receive €1800 a week in the high season. The apartment was lovely inside, but it had no outdoor space and you could just about see the sea if you crooked your neck. The owners comparison was a high end apartment complex directly on the sea front with a nice sized balcony and a roof terrace. What I advised him to do was to look at the market below his property. In Marseillan it is possible to rent a 3 bedroom house with roof terrace for €700 per week. The interior is old but comfortable. How could he justify the extra price difference of +€1100 per week. A potential client could stay in the townhouse, eat out at restaurants every single night and still be in profit by the end of the week.

The other reaction I often see is that people like the idea of having a second home in France and if they rent it out, they want the tenant to cover every conceivable cost that they incur. So they want the tenant to cover their mortgage, the cost of their taxe fonciere, their maintenance bills, gardener, pool guy, security alarm - you name it! It doesn't matter if the local market price of their house is €800 per month + bills, the Owner needs to earn at least €1400 per month in order for the house to 'wash it's face'.

But that is not how it works. If you rent out your second home, the rental incomes will be useful revenue towards the annual running costs of the house, there is no guarantee that it will cover all of your running costs. And as we have explained above, every month that your second home stands empty, you will have to stump up the full running costs of the house.

So my first bit of advice when calculating your potential rental income is to put sound business economics before vanity.

South France Investment property calculator

So, down to the central issue. What will your property be worth in terms of rental income. As a rough rule of thumb, these are some fundamentals when it comes to calculating rental income on properties in South France:

- Every 10 kms you travel away from the beach you lose €100-200 per week in high season and €50 per month for long term monthly rentals

- A private pool plus 4 bedrooms and within 25 kms of the coast you are virtually guaranteed 8 weeks high season rentals and 4 weeks June or September rentals

- A private pool adds between €500-€700 per week to the value

- A shared pool adds between €200-€300 per week to the value

- A roof terrace or balcony increases rentability, but not necessarily the weekly value. What it does do however is increase your occupancy level

- If you property has not outdoor space, it simply will not rent (unless it is walking distance to the beach or located within a popular town)

- Your weekly price in high season is usually what you can expect to earn per month for long term winter rentals (or if your property has a swimming pool, you will normally be able to charge 45% of the high season weekly price per month - so a property that rents for €2500 per week in the summer, will rent for €1200 per month + bills in the winter)

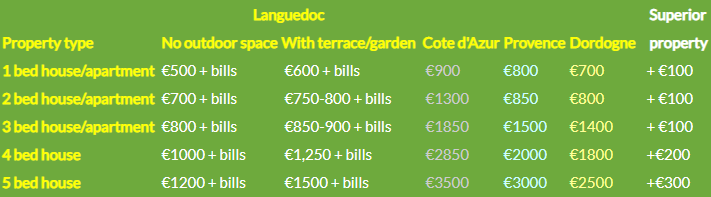

In terms of long term rentals over the off-season, these are the guide rental prices that you should expect to receive for monthly rentals between October to May each year:

What we can see is that there are in effect 2 different rental markets for the South of France. There is a rental market for properties in the Languedoc (Occitanie), Dordogne and Midi-Pyrenees; and a different rental market for the Cote d'Azur and parts of Provence.

What we can see is that there are in effect 2 different rental markets for the South of France. There is a rental market for properties in the Languedoc (Occitanie), Dordogne and Midi-Pyrenees; and a different rental market for the Cote d'Azur and parts of Provence.

In terms of long term rental periods over the summer months or 12 month annual rentals, the rental price will generally be down to negotiation, but you will be looking at paying at least a 20% premium on the monthly rental rate, to cover the higher rates the Owner normally charges in the summer..

It should be remembered however, that any property with a private swimming pool will be able to rent out for summer holiday rentals quite easily (and be able to charge per week at least double the off-season monthly rental price).

Thinking of renting your house in France in 2023 . . . ?

If you are interested in renting out your property in France for either long term rentals, summer rentals, or a combination of both; or if you have any further questions about some of the points raised in this article, then we would love to hear from you. You can contact us by Email.

Further information about renting property in France can be found in the following articles:

- Buy to holiday let property investment in France - a business model for exploiting the unique rental market in the South of France, with high yields from summer rentals and steady income from long term rentals throughout the rest of the year.

- Rental calculator investment property South France in 2023 - the latest property rental rates based on market information in France.

- Marketing your property in France for long term lets - further information on how to attract long term rental tenants to your property in France

If you are interested in buying an investment property in South France or perhaps, maybe even considering selling your second home in France, then we can certainly recommend that you speak to our business partner, Artaxa Immo.

Artaxa Immo, is a French real estate business that specialises in helping Foreign investors buy French property. The agency is based in the beautiful wine village of Roujan and provides a property sales teams across the Languedoc region. Artaxa is a genuinely International real estate firm, employing multi-lingual staff in the three regional offices.

For further information about buying property in South France, please contact Jane Laverock on +33 6 95 50 19 21 or by email at