Mortgage rates in France are predicted to fall to 2.75% during 2024, before returning below 2.5% during the early part of 2025. The long term interest rate in France currently stands at 3.19% (November 2023) and the interest rate on French Mortgages climbed to 3.6% in Q3 2023. The month of November however, saw the first fall in interest rates in France in over 2 years. [SOURCE: CEIC Data Jan 2023"].

During 2023, the French housing market slowed significantly. The almost quadrupling of interest rates in eighteen months, plus the tightening of lending criteria has led to a slump in house sales and triggered a corresponding fall in house prices. But French mortgage rates should start stabilising in the first quarter of 2024 and their are signs that the French government has (slowly) began to react to the difficulties faced by families and house buyers in France. It is expected that there will be a slew of measures introduced during 2024 to soften some of the banks’ lending criteria. It should be noted however, that it was the Government in France and the Banque de France which jointly created this problem in the first place (see below).

Here we outline the recent trend in mortgage rates and bank lending in France. We then look at the structure of the French mortgage market, before discussing the current state of the French property market. We conclude by explaining the application process for obtaining a French mortgage and some of the limitations and opportunities for foreign property investors in 2024.

Mortgage rates in France 2020-2024

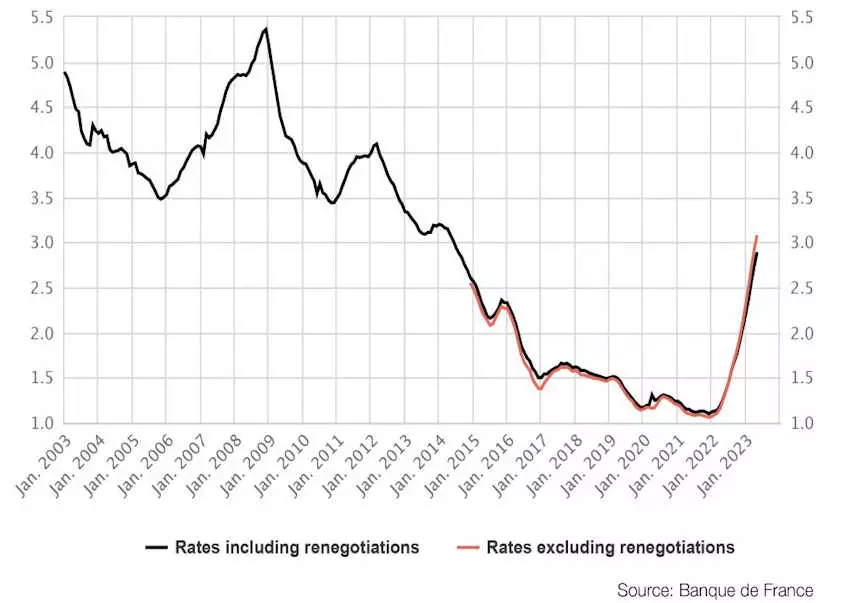

French mortgage interest rates 2015-2022 [SOURCE: Banque de France]Throughout 2020 and 2021 and up to the mid-point of 2022, the interest rates on French mortgages remained at historically low levels (reaching a 50-year low of 1.05% in December 2021) and this has helped to keep the French housing market in a very healthy state.

French mortgage interest rates 2015-2022 [SOURCE: Banque de France]Throughout 2020 and 2021 and up to the mid-point of 2022, the interest rates on French mortgages remained at historically low levels (reaching a 50-year low of 1.05% in December 2021) and this has helped to keep the French housing market in a very healthy state.

During 2023, Mortgage interest rates rose from to 2.5% in December 2022 to 3.63% in August 2023. This was expected to be the high point of mortgage rates in France, with rates decling to around 3.0% by the end of 2023 before falling to 2.75% in 2024 [SOURCE: France Interest Rates 2023 www.tradingeconomics.com].

The interest rates on French Mortgage during the period 2022 to 2023 rose sharply, as the French government and European countries look to reign in the high levels of inflation caused by the surge un Energy costs as a result of the war in Ukraine.

Whilst the increase in mortgage interest rates wasn't as severe in France as other European countries (Germany, Spain and Italy all recorded steeper rise), the knock-on effect on the French housing market was dramatic.

House sales in France declined by over 20% during 2023 and prices began to fall by around 1.8% overall.

But the rising interest rates in themselves were only part of the cause of the slump in the French property market during 2023. It was primarily regulatory changes which precipitated the fall in the property market.

Slump in French Property Market in 2023

During 2023, the French Mortgage market experienced a severe tightening. The main damage to the Mortgage market in France was the result of clumsy efforts from the Government and Banque de France to dampen the levels of consumer debt.

At the beginning of 2022, the Government introduced a new law in France which restricted new mortgage loans to a maximum of 25 years (previously you could obtain a loan over 35 years) and capped the amount that could be borrowed (including for fees and insurance) to 35% of the borrower’s income. This is called “taux d’usure” is calculated before tax and takes into account all other mortgages, loans and credit cards.

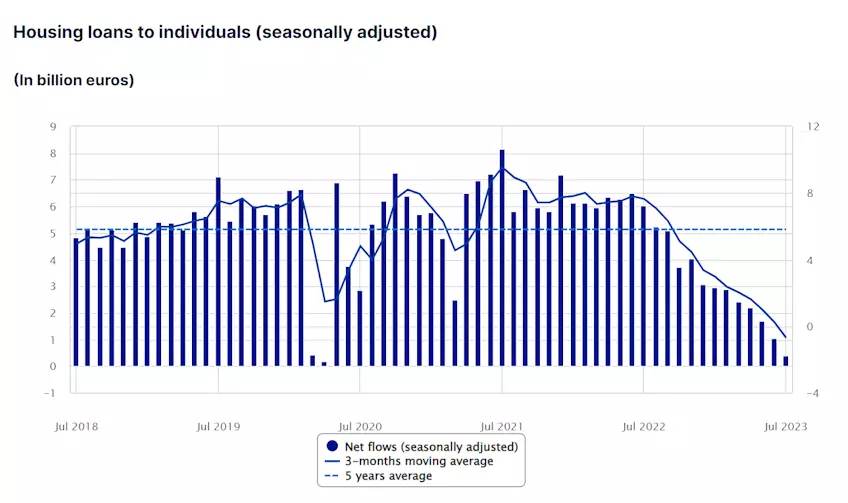

Housing loans in France 2018-2023 [SOURCE: Banque de France]The aim of the measures was to put a dampener on the level of consumer debt in France, which had been rising steadily over the previous 5 years. But in my opinion, this was like taking a sledgehammer to crack a nut. Yes consumer debt had been rising as a proportion of income levels, but at the same time, property prices had increased by 27.8% in France over the last 5 years, meaning that there were an awful lot of French home owners who had seen a dramatic increase in the capital value of their house. So I would argue that this should have been factored into the equation.

Housing loans in France 2018-2023 [SOURCE: Banque de France]The aim of the measures was to put a dampener on the level of consumer debt in France, which had been rising steadily over the previous 5 years. But in my opinion, this was like taking a sledgehammer to crack a nut. Yes consumer debt had been rising as a proportion of income levels, but at the same time, property prices had increased by 27.8% in France over the last 5 years, meaning that there were an awful lot of French home owners who had seen a dramatic increase in the capital value of their house. So I would argue that this should have been factored into the equation.

Also, at a time when the French Government was telling the French people that they would all have to work longer (raising the retirement age to 64), these reduced term limits on mortgages seemed to be counter-intuitive.

Inflation was increasing during 2021-2022, as a result in the surge in energy prices following the war in Ukraine, so it was an educated guess that interest rates would have to rise to combat this. So you can understand the concern of the French government that some French borrowers would struggle with rising mortgage repayments. But they could have targetted support on those people, instead of clobbering everybody. Also, if they looked at the structure of the French Mortgage Market (see below), they would have realised that only a small percentage of French borrowers were on variable rate mortgages. The majority of exisiting housing loans in France are fixed rate mortgages.

Towards the end of 2023, I heard reports from local Real Estate agents and Mortgage Brokers, that some banks in France had simply stopped giving out new mortgages, because they had reached the upper limit of the lending amount that the Banque de France had stipulated. A lot of house buyers were being told to re-submit loan applications in early 2024.

You can see the impact these regulatory changes had on the Mortgage market in France from this chart produced by the Banque de France. In December 2023, following sustained pressure from from financial institutions, banks, mortgage lenders and Real Estate agents, the Government began to back-track. The French Finance Minister and the Banque de France conceded that in cases where at least 10% of the housing loan will go towards renovation works, the loan repayments can be spread over 27 years instead of 25 years. However, the current maximum limit of 25 years for a standard mortgage will remain. During 2024, I expect that more 'reforms' will be announced, especially considering that the measures unfairly penalise first-time buyers.

French mortgage market structure

The structure of the mortgage market in France, has helped shield a lot of French borrowers from the impact of rising interest rates. Around 85% of housing loans in France are repayment mortgages. The relative stability of fixed rate mortgages in France, has allowed the country's mortgage market to continue to grow even despite the crash of 2007, the recent Coronavirus Pandemic and the Energy crisis of 2022.

In addition, with house prices rising for 5 consecutive years between 2017 to 2022, this has enabled French property owners to build up higher levels of capital in their houses (as outstanding loan amounts are reduced and property valuations increase). Over the past decade, the French mortgage market has expanded tremendously. According to the National Institute for Statistical and Economic Studies (INSEE), France has one of the world's largest mortgage markets and French mortgages have increased in value from 21% of France's GDP in 2000, to 44% of GDP in 2022.

House prices in France 2023-2024

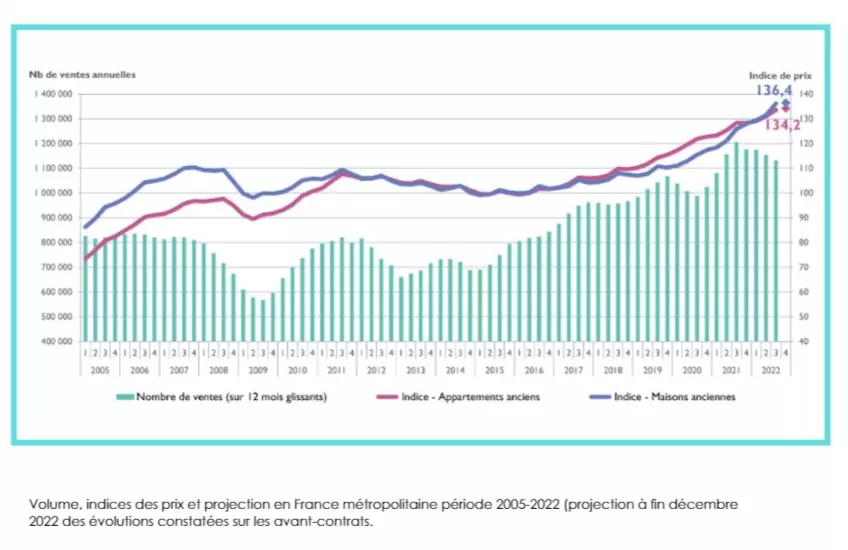

During 2022 house prices in France continued to increase by +6.7% (with the average price for houses recording an increase of +8.2% and apartments at +4.5%). During 2022, the number of house sales in France remained above 1.1 million, with sales reaching 1,133,000 in the 12 months up to Q3 2022 - which is the 6th highest quarterly rate in the last 17 years [SOURCE: Bilan Immobilier 2022 notaires.fr].

During 2022 house prices in France continued to increase by +6.7% (with the average price for houses recording an increase of +8.2% and apartments at +4.5%). During 2022, the number of house sales in France remained above 1.1 million, with sales reaching 1,133,000 in the 12 months up to Q3 2022 - which is the 6th highest quarterly rate in the last 17 years [SOURCE: Bilan Immobilier 2022 notaires.fr].

The Notaires de France has noted that the housing market in France over the last 5 years has witnessed almost unprecedented levels of growth both in terms of prices (house prices have increased by +27.8% over the last 5 years in mainland France) and the number of property sales - the rolling average of property sales have hit over 1 million in 13 out of the last 20 quarters. (Source: www.notaires.fr).

This headline figure does mask some regional differences in house prices in France, but history suggests that the long-term trend of property prices in France is definitely upwards. What is of particular interest is that the UK's Brexit decision does not seem to have a significant effect on the numbers of British buyers showing an interest in the French property market.

FNAIM, the professional body for real estate agents in France is forecasting house price increases of +5.0% in France during 2023 (Source: FNAIM.fr).

From a long term investment perspective, the French property market is a fairly decent bet. The property market in France has proved over recent history that it is sufficiently robust and stable to withstand temporary periods of decline. This is mainly the result of the structure of the French mortgage market. In France, 84.4% of borrowers take out fixed rate mortgages, making the French housing market less prone to the sharp upturns and downturns of other countries. French property is also one of the most well-regulated markets in the world, which helps to reassure investors about the long-term future.

How to obtain a French Mortgage in 2024

So if you are tempted to buy property in France during 2024, how do you go about it? The French mortgage market is mainly made up of fixed rate repayment mortgages. This has always been cited as a major factor in helping to stabilise the French housing market. Floating-rate loans only make up 6% of new loans in France.

French mortgages have some particular features that make them very attractive foreign house buyers. The Mortgage rates offered by French banks on residential property are typically lower than those in the UK and Ireland.

Currently, you can fix a French mortgage rate for as low as 3.15% for the lifetime of the loan, so any future interest rate rises will not affect your monthly payments. Also, most French mortgages have little or no early repayment charges. So if you are able to, you can pay off your mortgage early and benefit from substantial savings in interest, without any penalties.

French banks offer both fixed rate or variable rate mortgages (although as we have seen above, fixed rate mortgages are the preferred option). The banks generally lend up to 70-80% of the purchase price before tax. As a rule, to be eligible for a French loan, your debt ratio must be no more than 33%, i.e. all your monthly debt repayments should amount to no more than a third of your monthly income.

Variable rate mortgages are usually based on the EURIBOR (European Inter Bank Offer Rate) plus a loading. It is normal for applicants to be charged a fee by the lender, which is typically 1% of the amount borrowed. Most lenders will insist that the buyer undertakes a survey and takes out some form of life/disability insurance.

Also, International Private Finance report that a new French mortgage product has been launched which offers a capped variable interest only rate of 2.20%. The loan has a protection cap of 1% for the first 7 years. On a loan of €250k, spread over 14 years and with a loan-to-house-value rate of 75%, the monthly payments would be €458. Furthermore, as the loan is a variable rate it also comes with no early redemption charge.

The company also report that in terms of more traditional repayment mortgages, there are loans available for as low as 2.10% for a fixed rate mortgage over 20 years (a monthly payment of €1,461 on a €250,000 loan) and some French banks are providing a 1.85% variable rate mortgage over 5 years.

SOURCE: www.internationalprivatefinance.com

When buying a second home in France, there are three ways to raise the mortgage:

- against an existing property in your country, providing there is sufficient equity;

- against the French property;

- a mixture of both.

Mortgage on your main property

Raising capital against your principal property is usually the cheapest option. The mortgage funds are raised either by taking further borrowing on the current mortgage or by re-mortgaging to another lender. The fees involved are relatively small and the process is straightforward and familiar.

Taking a Mortgage on your French Property

Raising a mortgage secured against the French property allows buyers to purchase a property without putting their principal home at risk. Although the costs are higher, with low interest rates in France remaining below 3.5% for much of 2023, it could be an attractive option. There can also be tax advantages if you let out the property.

Hybrid mortgages

Raising money against your principal home and your French property is popular with purchaser who do not have large deposit in savings or who want to keep their savings intact. Basically, the deposit and costs are raised on your principal home, limiting the amount of equity; while the difference is raised against your French property.

Raising money against your principal home and your French property is popular with purchaser who do not have large deposit in savings or who want to keep their savings intact. Basically, the deposit and costs are raised on your principal home, limiting the amount of equity; while the difference is raised against your French property.

Paddy Gibbins the Managing Director of Artaxa Immo, a French real estate business that specialises in helping Foreign investors buy French property, states that he has seen a growing trend in hybrid mortgages in France, whereby investors raise money against their principal home and the French property. This is proving especially popular with purchasers who do not have a large savings pot to pay the deposit or clients who want to keep their savings intact. Paddy explains that the general process is that:

"basically, the deposit and purchasing costs are raised on the principal home of the purchaser and the equity for the loan is raised against the French property".

French mortgage applications

When you approach a French bank for a mortgage you will need to supply all the following documents:

- Valid passport or identity card

- Telephone (land line) or gas bill or electricity bill

- Birth certificate

- Marriage certificate

- Bank account statements for the last three months

- Contracts and repayment schedules for all current loans

- Proof of principal residence (e.g. a council tax bill) or copy lease with receipt for last rent payment if you are lessees

- Copies of the last three wage slips - and the contracts if employed for less than 18 months

- Latest tax return or official statement of income at the end of the last year

- Proof of the amount of personal capital contribution to the purchase (e.g. savings account statement)

The bank will study your dossier and if all is in order, make you a preliminary offer. This normally takes about 48 hours. They will then send you documents for you to open an account with them (if you do not already have one) and also an insurance policy (together with health questionnaire) to sign. The bank account is a current account (for the purposes of transfers of money related to the loan). You are obliged to have a French bank account if you want to take out a French mortgage. The insurance policy is similarly obligatory. It insures the loan and must be signed and sent back at the same time as the offer document.

French Mortgage calculation

French Mortgage calculations vary between the lenders. Some have a higher minimum loan size or lower maximum loan value. Banks generally consider loans from between 65% to 85% of the value of the property. Generally French banks work on a principle that the total of the French mortgage plus any other borrowing or rent should not exceed a third of the buyer's gross monthly income.

French Mortgage charges

The bank charges for arranging a mortgage are usually:

- administration - a flat fee of approximately 1% of the loan amount.

- the cost of the garantie hypothecaire or mortgage registration - amounting to approximately between 1.5% and 2% of the loan amount.

- A mortgage broker will typically charge you either a flat fee (usually several hundred pounds/ Euros) or a percentage (around 0.75%) of your total purchase price. Artaxa Immo will organise your loan for no fee as part of their service.

See also Buying a house in France, The 10 best places to live in France in 2024 and French Property Taxes.

Thinking of moving to France in 2024 . . . ?

Paddy Gibbins is the Managing Director of Artaxa RE/MAX, a French real estate business that specialises in helping Foreign investors buy French property. The agency is based in the beautiful wine village of Roujan and provides a property sales teams across the Languedoc region. Artaxa is a genuinely International real estate firm, employing multi-lingual staff in the three regional offices.

Paddy Gibbins is the Managing Director of Artaxa RE/MAX, a French real estate business that specialises in helping Foreign investors buy French property. The agency is based in the beautiful wine village of Roujan and provides a property sales teams across the Languedoc region. Artaxa is a genuinely International real estate firm, employing multi-lingual staff in the three regional offices.

For further information about buying property in South France, please contact Jane Laverock on +33 6 95 50 19 21 or by email at Jane@artaxaimmo. Alternatively, if you have any particular questions you would like to ask about living in the South of France, then contact Iain by Email.