French property market 2024: great for cash-buyers but a struggle for everyone else

- Last updated on .

- Hits: 3772

Following a year of declining sales and a fall in house prices in France, 2024 is forecasted to be a 'challenging year' for the French property market. Up to August 2023, house sales fell by -16.6% in France (down from 1.2 million to 955,000) and house prices fell by just under 1%.

The end of 2023 witnessed a very depressed housing market in France. Here we explain the reasons for this decline and why 2024 could be a good year for some cash buyers in France.

French Property Market 2023

If you look at the French Property Market in 2023, there are 3 immediate challenges that come to mind: inflation, rising interest rates and tightening supply. If anything, 2023 was the year when the property boom in France came to an abrupt end.

The fight against inflation in France in 2023

During 2023, the rate of inflation in France fell from the previous high of 6.5% in Q4 2022 to 6.0% in Q2 2023 and then down to 5.0% in Q3 2023. The inflation rate in France is expected to fall to 4.0% by the end of 2024 and then down to 2.5% during 2025.

[SOURCE: Banque de France]

France was a lucky compared to a lot of European countries, in that it only imports around 18% of its energy needs. This meant that the rise in inflation during 2022, was only limited to 6.5% (compared to around 10% in Germany and the UK). But inflation still remained an issue and needed to be combatted.

The French Government's efforts to fight inflation in 2023 had many facets. Some were very successful, such as taking action to limit the increase in electricity prices that EDF could charge domestic households. Similarly, efforts were made to work with the French supermarkets to reduce the price increases for a range of staple goods. The French government also announced new funding for households transitioning away from oil and gas for domestic heating and greater efforts to support the installation of solar panels and improve the insulation of French homes.

But action by the French Central Bank to tighten the supply of money in France, led to a virtual collapse in the French mortgage market and resulted in a severe downturn in the French property market. Whether it was by design or an unfortunate consequence, by Q4 2023, it was very difficult for French home buyers to secure mortgages and virtually impossible for foreign buyers to obtain financing in France. In short, the banks stopped lending. Even if home buyers could arrange home loans, the interest rates being charged roase rapidly during the year.

French interest rates in 2023

French Mortgage rates in December 2021 were at an historic 50-year low of 1.05%. During 2022, mortage rates in France began to climb to 2.5%, but in 2023 the interest rates on housing loans in France accelerated to 3.63% (Q3 2023) and reached nearly 6.0% for general consumer loans.

The only good news for French homebuyers at the moment, is that mortgage interest rates are forecast to return to below 2.5% during 2025. But the interest rates themselves are not the real problem for French borrowers. The primary issue is actually obtaining a loan in the first place

[SOURCE: Banque de France]

Tightening of French Mortgage market in 2023

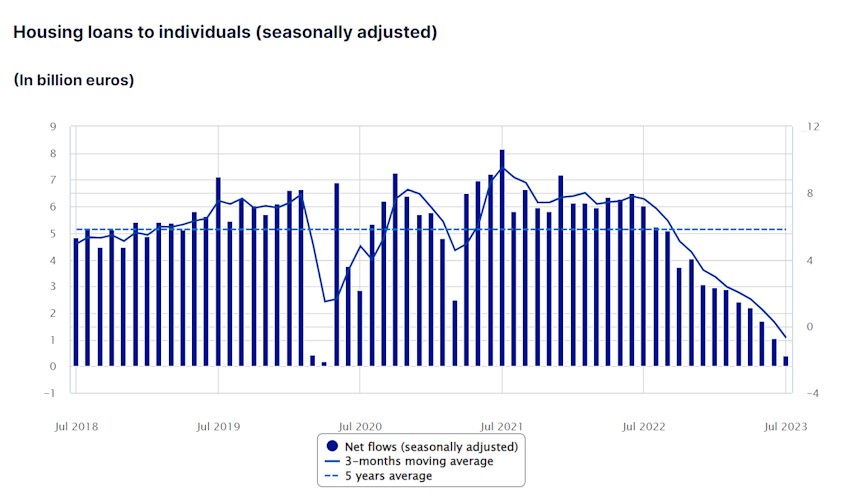

Housing loans in France 2024 [SOURCE: Banque de France]During 2023, the French Mortgage market experienced a severe tightening. The rising interest rates in France were only part of the cause, with many potential borrowers deciding to pause their plans to move house until interest rates have stabilised.

Housing loans in France 2024 [SOURCE: Banque de France]During 2023, the French Mortgage market experienced a severe tightening. The rising interest rates in France were only part of the cause, with many potential borrowers deciding to pause their plans to move house until interest rates have stabilised.

The main damage to the Mortgage market in France was the result of clumsy efforts from the Government and Banque de France to dampen the levels of consumer debt.

During 2022, the Government introduced a new law in France which restricted new mortgage loans to a maximum of 25 years (previously you could obtain a loan over 35 years) and the amount that can be borrowed (including for fees and insurance) was capped at 35% of the borrower’s income.

There were also reports that by the end of Q2 2023, some banks in France had stopped giving out new mortgages, simply because they had reached the upper limit of the amount they could lend during the year (as stipulated by the Banque de France). A lot of house buyers were being told to re-submit loan applications in early 2024.

You can see the impact these regulatory changes had on the Mortgage market in France from this chart produced by the Banque de France. I believe that these regulatory changes will lead to a reduction in the number of house sales in 2024 and it may not be until 2025, that the number of house sales in France will get close to the 1 million mark (where it has been since 2018).

French property Market 2024

Despite all the doom and gloom, it is important not to forget that the housing market in France over the last 5 years has witnessed almost unprecedented levels of growth.

House prices have increased by 27.8% over the last 5 years in mainland France. Property transactions have topped the historically significant 900,000 mark in every year since 2017 and the rolling average of property sales have hit over 1 million in 13 out of the last 20 quarters. So the last 5 years have been a house sellers dream.

In 2024, I think that it is going to be extremely difficult for people looking to sell their house in France. I know this for a fact because I am married to a Real Estate agent and her earnings collapsed by almost 60% during 2023 and 2024 doesn't look to be any better. The main issue for sellers, is that the pool of potential buyers has shrunk rapidly (due to the difficulty in obtaining loans and the high interest rates) and prices have only just started to fall.

A recent report by the Notaires de France, highlighted the issue:

" . . .The housing market, after mostly benefiting sellers, has now turned around. There can be a breakthrough only when sellers agree to lower their price, which, given the rises in recent years, is by no means unacceptable. But there is always a lag between falling demand and sellers agreeing to reduce their prices. 2024 looks like the year of adjustment, when prices fall to match the lower demand . . ."

[SOURCE: French Property Market Report 2023, Notaires.fr]

Collapse in house prices in France? I don't think so.

So basically, I think 2024 will see the French Property Market return to previous trends. After all, it is only in recent years that we have seen such a rapid growth in the total number of house sales and a strong growth in house prices. If you look back over the last 20-30 years, property sales in France averaged around 700,000-800,000 a year. They did not breakthrough the 900,000 barrier until the second quarter of 2017. I think that house prices in France may fall a bit in 2024 (perhaps by 1-2%), but not by as much as people think.

One thing that we noticed even before the slump in house sales, was that there was a very noticeable shortage in the supply of houses for sale (especially in the areas where we operate such as the Herault and Gard departments in Southern France). In 2021 and 2022, there was a very noticeable trend of people moving out from the major cities to the provinces in France. This was a direct result of their experiences during the Covid confinements. This change in buying patterns helped soak up the supply of rural homes and properties in provincial towns (as well as arresting long term declines in population levels in rural areas).

But once people had made the move, they were unlikely to move again so quickly. Plus, with the rapid rise in house prices over the last 5 years, for existing home owners, why would they consider selling their house? Where would they move to? Similarly, land prices for new builds are probably the highest they have ever been and the cost of construction materials are about 20% above what they used to be prior to Covid and the Ukrainian war. So unless you are looking to move away from the region, you may as well stay put in your house. With the prospect of house prices falling slightly in 2024, I think people will be even less likely to move.

The return of the Foreign house-buyers in France in 2024

The one group of people who I think will benefit from the depressed French housing market in 2024, will be cash-buyers. As long as you don't need a mortage to fund a house purchase, then you are going to be in a much stronger position to negotiate a reduced purchase price.

The one group of people who I think will benefit from the depressed French housing market in 2024, will be cash-buyers. As long as you don't need a mortage to fund a house purchase, then you are going to be in a much stronger position to negotiate a reduced purchase price.

In addition, with inflation forecast to be brought under control by 2025 and with interest rates also likely to fall back to around 2.5%, it is likely that the French Government will take the shackles off the French mortgage market. This will result in a great level of activity in the French property market, which in turn will stop the slide in house prices.

So 2024 could offer cash-buyers some interesting options, especially Foreign buyers.

Some recent research by the National Notaires body in France, highlighted a growing trend in the number of foreigners buying houses in France. The report highlighted how:

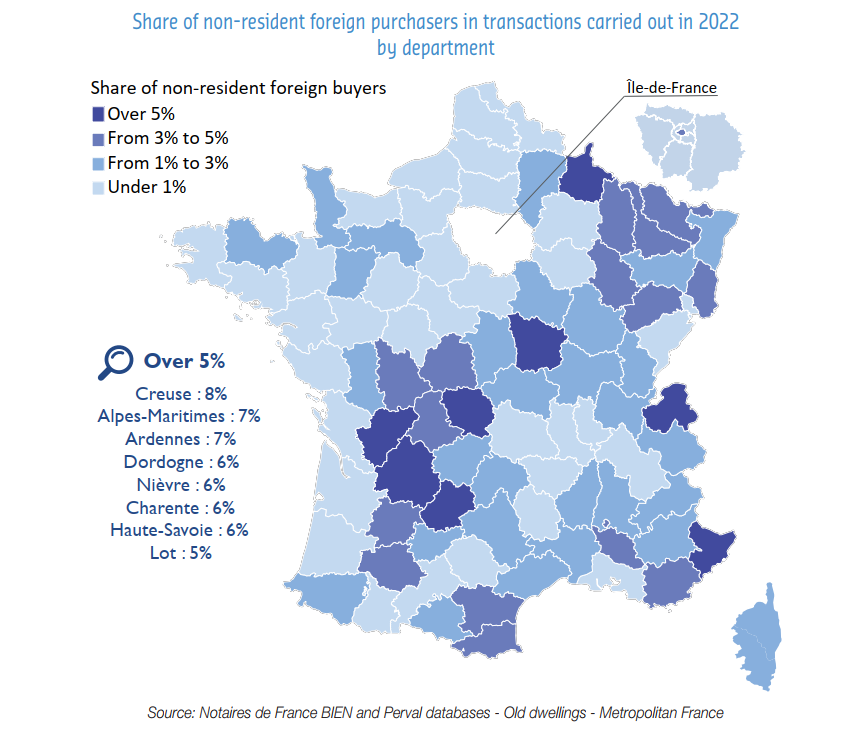

After reaching its highest level in 2015 at 2%, the share of non-resident foreign purchasers in mainland France fell almost continuously until 2020. But 2022 marked the return of non-resident foreign purchasers, who now account for 1.8% of old housing purchases in France and a trend which has continued into 2023.

What is interesting is that it isn't the usual popular areas of France leading the way, such as Provence, Dordogne and Britanny. It is the departments of Creuse, Alpes-Maritimes and Ardennes which are proving to be the most popular departments for non-resident foreign buyers in 2023. The rural department of Creuse, in Central France, has for many years suffered a declining population. But in 2023, over 8% of property sales within the department were made by non-resident foreign buyers (probably attracted by some of the lowest property prices in France and the beautiful countryside). In Alpes-Maritimes, on the Mediterranean coast bordering Italy, the share of foreign non-resident buyers has reached 7% - a steady trend over the last 5 years. Meanwhile, the share of purchases made by non-resident foreigners in Ardennes has steadily increased, from 2% in 2013 to 7% in 2023.

The research also revealed a sharp fall in the number of British buyers in France between 2020 and 2021 (falling by 6% over this 2 year time period). This is obviously a lasting effect of the Brexit vote, although recent changes in French law in 2023 (providing for non-visa stays of up to 6 months for British second home owners and reducing the French tax & social charges on rental income from second homes), should help to stabilise this important sector of the French property market. British customers still represent nearly one-fifth of all foreign property buyers in France. Other important groups include the Belgians (19%), the Germans (11%), the Dutch (10%) and the Swiss (7%).

[SOURCE: French Property Market Report 2023, Notaires.fr]

French property Market 2024 - struggling on

So in summary, the economic challenges during 2023, in particular the fight against inflation, have led to a strong decline in house sales and a corresponding fall in house prices. But with interestes rates forcasted to fall during 2024 and into 2025, the French property market should begin to stabilise. The key issue however, will remain the availability of housing loans in France. This will put a break on the French housing market. For cash buyers however, 2024 could be a very good time to purchase a property in France.

Thinking of moving to France in 2024 . . . ?

Artaxa RE/MAX Immo, is a French real estate business that specialises in helping Foreign investors buy French property. The agency is based in the beautiful wine village of Roujan and provides a property sales teams across the Languedoc region. Artaxa is a genuinely International real estate firm, employing multi-lingual staff in the three regional offices. For further information about buying property in South France, please contact Jane Laverock on +33 6 95 50 19 21 or by email at Jane@artaxaimmo. Alternatively, if you have any particular questions you would like to ask about living in the South of France, then contact Iain by Email.

Artaxa RE/MAX Immo, is a French real estate business that specialises in helping Foreign investors buy French property. The agency is based in the beautiful wine village of Roujan and provides a property sales teams across the Languedoc region. Artaxa is a genuinely International real estate firm, employing multi-lingual staff in the three regional offices. For further information about buying property in South France, please contact Jane Laverock on +33 6 95 50 19 21 or by email at Jane@artaxaimmo. Alternatively, if you have any particular questions you would like to ask about living in the South of France, then contact Iain by Email.